The letter would also include the bank’s details, such as the branch location and contact information, and might mention any relevant terms and conditions associated with the deposit, including interest rates if applicable. It is usually signed by a bank representative to authenticate the transaction. The Letter of Deposit thus provides a single person with a secure acknowledgment from the bank, ensuring that their funds are safely accounted for in the bank’s ledger.

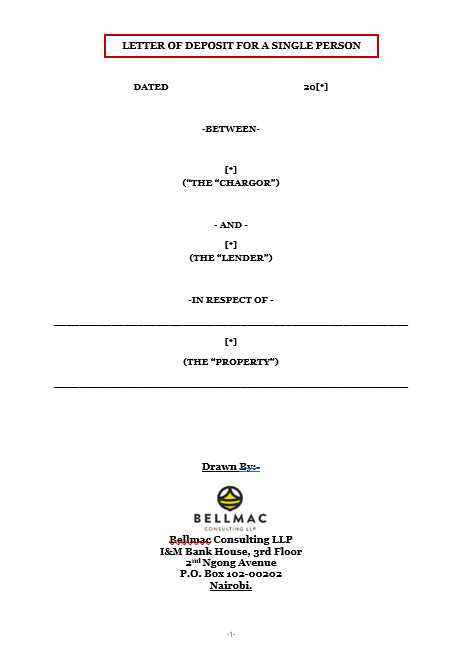

Letter of Deposit for a Single Person

KShs 3,000

A Letter of Deposit is a formal document that serves as a testament to the deposit of funds by an individual into a financial institution. For a single person, this letter would typically outline the depositor’s name, the account into which the funds have been deposited, the date of the deposit, and the amount. It acts as a confirmation from the bank that the transaction has occurred and provides the depositor with a tangible record of the deposit. This document can be particularly important for a single person as it serves as proof of financial resources, which may be required when applying for loans, housing, or even visas.